change in net working capital formula

To calculate our change in working capital we will take all the items from the assets and add them together. Current Operating Assets 50mm AR 25mm Inventory 75mm.

Change In Net Working Capital Nwc Formula And Calculator

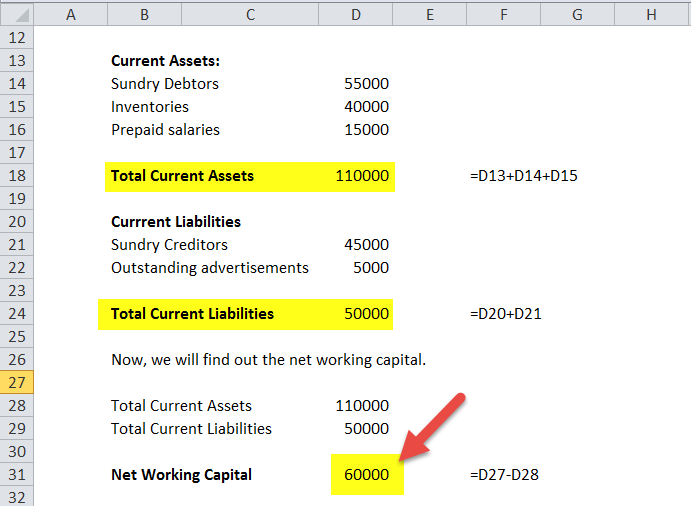

So the change in NWC is 135000.

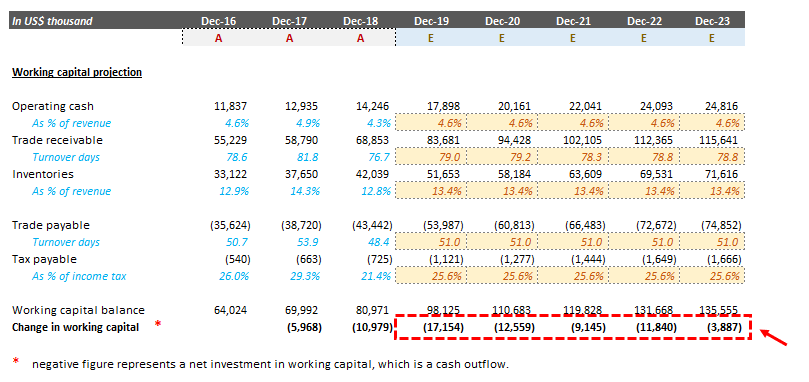

. Example calculation with the working capital formula. Changes in the net working capital on the other hand is the difference between the NWC of any two periods -years or quarter or month. A companys net working capital can experience changes too which can affect cash flow.

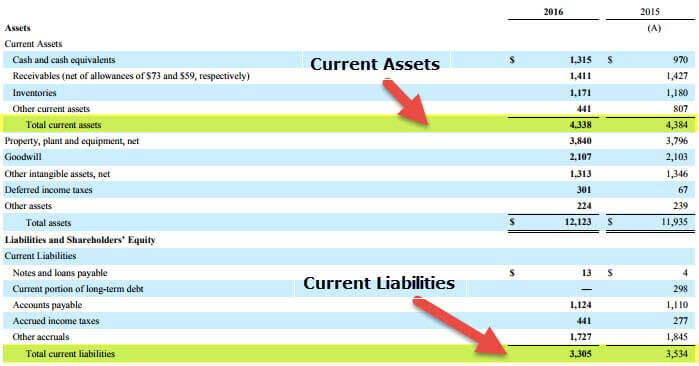

Non-cash working capital receivables inventory payables. Below is an example balance sheet used to calculate working capital. 52 Working capital investments Net Working Capital Ratio Be sure to include these.

The formula for working capital is current operating assets minus current operating liabilities. That difference is your working capital WC. To calculate days working capital it is necessary to know the average working capital and sales revenue.

As a routine check you must confirm that if the NWC grows from year to year the change should be reflected as negative cash outflow and the change will be positive cash inflow if the NWC decreases. The change in working capital formula is straightforward once you know your balance sheet. Non-cash working capital 10000 200000 25000 30000 Non-cash working capital 155000.

The formula to calculate net working capital is current assets less current liabilities. The Net Working Capital Change NWC formula subtracts the current periods NWC balance sheet from the previous periods NWC balance sheet. Thus if net working capital at the end of February is 150000 and it is 200000 at the end of March then the change in working capital was an increase of 50000.

240000 2022 105000 2021 135000. Here you can see the value comes out to be negative. In practical terms it would not make sense to calculate FCF all in one formula.

Changes in working capital are an idea that lives in the cash flow statement. If the price per unit of the product is 1000 and the cost per unit in inventory is 600 then the companys working capital will increase by. To do this the company subtracts its 200000 in.

FCF Net Income Non-Cash Expenses Incrase in Working Capital Capital Expenditures. Next compare the firms working capital in the current period and subtract the working capital amount from the previous period. Then we will do the same for the liabilities.

Subtract the previous years working capital from the current years working capital according to the calculations made above in the table. Current Operating Liabilities 40mm AP 20mm Accrued Expenses 60mm. As for the rest of the forecast well be using the.

Net Working Capital NWC 75mm 60mm 15mm. Pvt Ltd is as follows. Content Internal Financial Management Net Working Capital Formula Example Change in Net Working Capital Calculation Colgate Subtract expenses Part 6.

Instead it would usually be done as several separate calculations as we showed in the first 4 steps of the derivation. A company can increase its working capital by selling more of its products. As per the above table the Net Working Capital of Jack and Co.

Regardless of the formula they used the investor could determine that the amount of future assets is. The last step is to find the change in net working capital. NWC is a measure of a companys liquidity operational efficiency and short-term financial health.

The last step is to determine the change in working capital by using the formula. The ideal position is to have more current assets than current liabilities and thus have a positive net working capital balance. For most companies you analyze by using the change in working capital in this way the FCF calculation and owner earnings calculation is similar as it.

Several more changes that can affect the net working capital include. For instance new projects business expansion and cash usage are changes in processes that can affect the net working capital. The simplified formula is.

Owner Earnings 8903 14577 5129 13312 2223 13084. Wait Why Dont the Cash Flow Statement and Balance Sheet Figures Match. Thus the value of working capital in 2021 comes out to be -9972000000.

This indicates that the firm is out of funds. Changes in working capital -2223. For example a company with 10 days working capital for a given period will take double the time to turn its working capital into sales as compared to a firm with 5 days working capital.

They could also use the second formula to create the equation below. Cash and Cash Equivalents Trade Accounts Receivable Inventories Debtors Creditors Short-Term Loans 135000 55000. Simply take current assets and subtract current liabilities.

The business would have to find a way to fund that increase in its working capital asset perhaps by selling shares increasing profits selling assets or incurring new debt. The Quick Ratio And Current Ratio. Net Working Capital Formula Current Assets Current Liabilities.

What are changes to net working capital. If a company has substantial positive NWC then Change in Net Working Capital. Given those figures we can calculate the net working capital NWC for Year 0 as 15mm.

Calculating changes in net working capital from one period to another is significant for a company to get a clear.

Net Working Capital Formula Calculator Excel Template

Change In Net Working Capital Nwc Formula And Calculator

Cash Flow Formula How To Calculate Cash Flow With Examples

Net Working Capital Definition Formula How To Calculate

Net Working Capital Definition Formula How To Calculate

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator

Change In Working Capital Video Tutorial W Excel Download

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Turnover Ratio Meaning Formula Calculation

Change In Working Capital Video Tutorial W Excel Download

Net Working Capital Formula Calculator Excel Template

Change In Working Capital Video Tutorial W Excel Download

Working Capital What It Is And How To Calculate It Efficy

Net Working Capital Definition Formula How To Calculate

Net Working Capital Meaning Examples Formula Importance Change Impact

Step By Step Guide On Discounted Cash Flow Valuation Model Fair Value Academy